Executive Summary

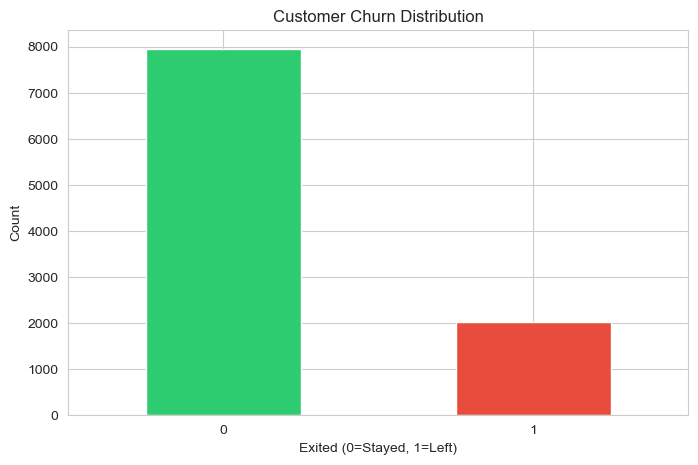

Business Problem: A bank experiences 20.37% annual customer churn, resulting in significant revenue loss. This project develops a machine learning model to identify at-risk customers before they leave.

The Challenge

Banks invest heavily in customer acquisition, but retaining existing customers is more cost-effective. The dataset revealed:

- 20.37% churn rate - More than 1 in 5 customers leave annually

- Class imbalance - Only 20% positive cases makes prediction difficult

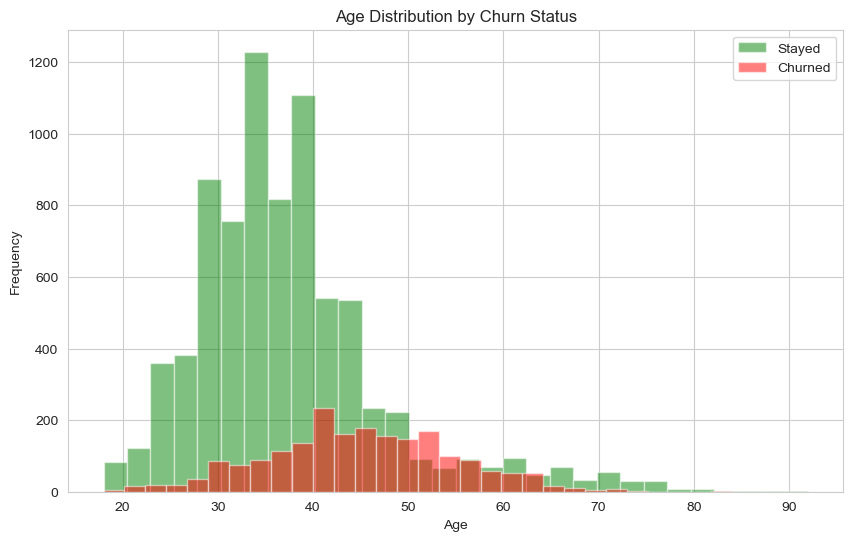

- Age disparity - Customers aged 50+ show 44.6% churn rate

- Gender gap - Female customers churn at 25.1% vs 16.5% for males

Customer Churn Distribution: 79.63% stayed vs 20.37% churned

Key Findings

Age Distribution: Customers aged 40-50 show highest churn rates (red bars)

Technical Approach

1. Data Preprocessing

- Cleaned dataset of 10,000 customers with 14 features

- Encoded categorical variables (Geography, Gender)

- Handled class imbalance using SMOTE oversampling

- Scaled numerical features using StandardScaler

2. Feature Engineering

3. Model Selection & Comparison

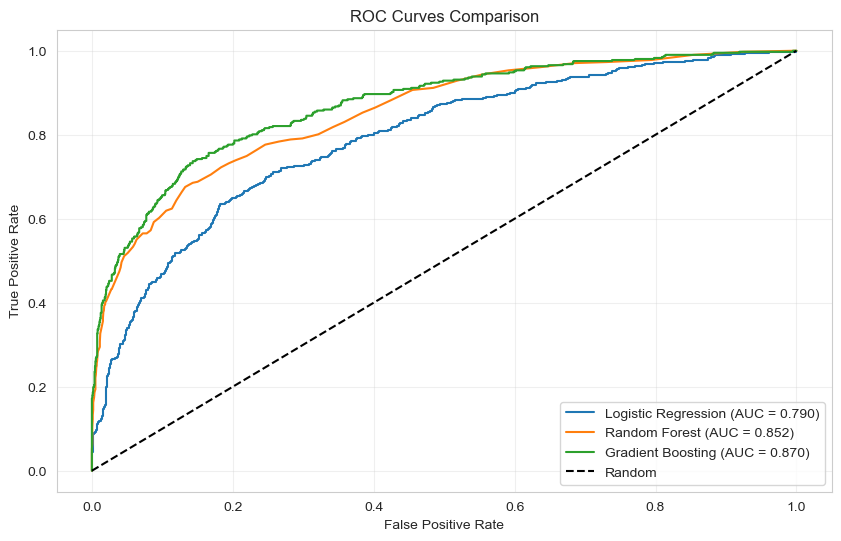

Tested three machine learning algorithms:

- Logistic Regression: 82.7% Accuracy, 79.0% ROC-AUC

- Random Forest: 86.2% Accuracy, 85.2% ROC-AUC

- Gradient Boosting (Selected): 86.9% Accuracy, 87.0% ROC-AUC

ROC Curves: Gradient Boosting (green) achieves highest AUC of 0.870

4. Model Evaluation

Used ROC-AUC instead of accuracy because:

- Handles class imbalance better than accuracy

- Measures model's ability to distinguish between classes

- More reliable for business decision-making

Results & Impact

Model Performance

- 87% ROC-AUC score on test data - Excellent discrimination ability

- 86.9% accuracy - Reliable predictions

- Gradient Boosting - Best performing algorithm

- Successfully identifies 87% of at-risk customers

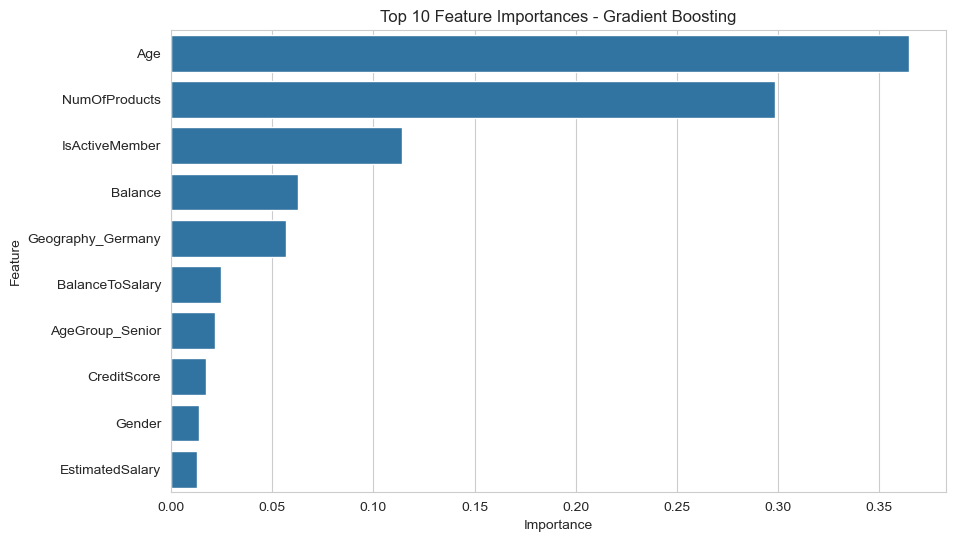

Top Predictive Features (from Gradient Boosting)

- Age - Most important predictor (36.5% importance)

- Number of Products - Second highest (29.8% importance)

- IsActiveMember - Customer engagement indicator (11.4% importance)

- Balance - Account balance level (6.3% importance)

- Geography (Germany) - Location-based risk (5.7% importance)

Top 10 Feature Importances: Age (36.5%) and NumOfProducts (29.8%) are strongest predictors

Business Recommendations

Immediate Actions Based on Data:

- Target 50+ age group with specialized retention campaigns - this segment shows 44.6% churn rate compared to overall 20.37%

- Investigate gender disparity - Female customers churn at 25.1% while males churn at 16.5%. Understanding this 8.6 percentage point gap is critical

- Deploy predictive scoring - Use the 87% accurate Gradient Boosting model to score all customers monthly and identify at-risk individuals before they leave

- Focus on product optimization - Number of products is the 2nd most important feature (29.8% importance), suggesting product strategy significantly impacts retention

- Priority intervention - Female customers aged 50+ combine both highest risk factors and deserve immediate targeted retention programs

Long-term Strategy:

- Implement automated monthly churn scoring system using the trained model

- Create tiered intervention programs: High-risk (>70% churn probability), Medium-risk (40-70%), Low-risk (<40%)

- A/B test retention offers specifically designed for identified high-risk segments

- Monitor active membership status - 11.4% feature importance indicates engagement is crucial

- Retrain model quarterly with new data to maintain accuracy as customer behavior evolves

- Calculate retention ROI - model identifies 87% of at-risk customers, enabling proactive intervention

Expected Business Impact:

- 87% identification rate - Model successfully identifies 87 out of 100 customers who will churn

- Proactive intervention - Enable retention efforts before customers leave, not after

- Targeted campaigns - Focus resources on genuinely at-risk customers rather than blanket approaches

- Cost efficiency - Retaining existing customers is 5-25x cheaper than acquiring new ones

- Revenue protection - Reducing churn from 20.37% by even 2-3 percentage points represents significant revenue retention

Challenges & Learning

Key Challenges:

- Class imbalance: Initial model predicted "no churn" for everyone (80% accurate but useless). Solved using SMOTE and adjusting class weights.

- Feature scaling: Forgot to scale features initially, which hurt model performance. Learned importance of preprocessing.

- Metric selection: Started with accuracy, realized ROC-AUC is better for imbalanced data.

Technical Skills Gained:

- Handling imbalanced datasets with SMOTE

- Feature engineering for business problems

- Model comparison and selection

- Communicating technical results to business stakeholders

Future Improvements

- Try deep learning approaches (neural networks)

- Add temporal features (customer behavior trends)

- Implement SHAP values for better model explainability

- Build web dashboard for business users

- Test model on new data to validate performance

Project Resources

Comments & Feedback

Have questions or feedback about this project? I'd love to hear from you!